What is eKYC?

eKYC (Electronic KYC) is a digital customer KYC verification procedure wherein the identifying details of a customer desirous of obtaining services from a regulated business are verified electronically.

eKYC primarily involves KYC verification through the UIDAI (Unique Identification Authority of India) database and is completely paperless, requiring no physical documentation.

The only prerequisite for eKYC is the possession of the 12-digit Aadhaar number. This, along with a registered mobile number (in most cases), is all customers need to complete KYC procedures.

eKYC & the Aadhaar revolution

eKYC has emerged as a digital alternative to form-based manual KYC processes, in no small part thanks to the introduction of Aadhaar.

The Aadhaar initiative was spearheaded by UIDAI and then chairman, Nandan Nilekani to bring all Indian citizens under the umbrella of digital identification. Under the Aadhaar program, every citizen of India is provided a unique identifier in the form of a 12-digit Aadhaar number, which serves both as a proof of identity and a proof of residence.

Despite being non-compulsory, the Aadhaar initiative already has several billion accounts of citizens, making it the largest digital identity initiative in the world. Demographic information of people signing up for Aadhaar is collected by UIDAI and stored in a database, from where eKYC service providers can obtain these details (following customer consent) to verify customer identity.

Both demographic and biometric information is collected for Aadhaar enrollment, and these are used for de-duplication to ensure the uniqueness and generate a unique Aadhaar number.

Here’s the information collected for Aadhaar.

- Demographic information – Name, Date of Birth (verified) or Age (declared), Gender, Address, Mobile Number (Optional), and Email ID (Optional)

- Biometric information – Ten fingerprints, Iris scan, Facial live picture

Note that this set of demographic information is collected only for self-enrollment in Aadhaar.

With this compendium of identifying information already present with UIDAI, retrieving and subsequently verifying this information is a relatively easy prospect and serves to expedite the KYC verification process.

eKYC involves exactly this procedure of information extraction from the UIDAI database and verifying these details for Customer Due Diligence (CDD) purposes.

What are the types of eKYC?

As described in the last section, an abundance of identifying details are now already present in the UIDAI database. In order to perform eKYC, service providers retrieve this information and use it to verify customer KYC.

A number of ways to perform eKYC have been instituted. The key aspect differentiating these varying methods is the step that allows service providers to retrieve customer information.

Online eKYC methods involve authentication through biometrics or an OTP and offline methods make use of XML files and QR codes for customer validation before information retrieval.

Here are the various types of eKYC.

1. Online methods

a. OTP authentication

In the case of OTP-based Aadhaar authentication, the customer will have to first register their mobile number.

During Aadhaar eKYC on a verification platform, the customer first consents to the procedure and generates an OTP which is sent to their Aadhaar-registered mobile number.

Upon entering this OTP, the customer’s Aadhaar is authenticated and the identifying information in the UIDAI database is pushed to the service provider for verification.

This completes OTP-based Aadhaar eKYC.

b. Biometric authentication,

In the case biometric authentication, a scanner is used to capture fingerprints or a retina image. These are sent to UIDAI and matched with the biometric data stored under the customer’s unique Aadhaar number.

Once the match is verified, UIDAI securely sends the customer’s identifying information to the verification service provider, who authenticates the information.

This completes biometric-based Aadhaar eKYC.

2. Offline methods

a. Aadhaar XML file

eKYC can also be performed offline using the XML file provision.

Here, the customer will first have to visit the UIDAI website and fill up the Offline eKYC form to download their unique XML file. This file will contain demographic information including Name, Date of Birth, Gender, Address, etc.

The Aadhaar XML file is readable by service providers and is used to extract the verifying information required to perform eKYC.

b. QR code

If you’ve got an Aadhaar card, you’ll have noticed the QR code on the card.

This QR code is unique and machine-readable. It contains the demographic information required to complete eKYC and can be read by code scanners to extract information, which is subsequently used for Aadhaar authentication.

SignDesk offers comprehensive eKYC verification services that support both online & offline Aadhaar authentication.

Who can perform Aadhaar eKYC?

While the Aadhaar initiative was created mostly to put India on the path towards complete digitization, it’s come to be extremely useful to ensure compliance with KYC regulations.

RBI’s CDD regulations lay down rules to perform eKYC; however, online eKYC methods, i.e OTP and biometric Aadhaar authentication are not to be used by private unregulated entities for KYC verification.

This resulted from a Supreme Court judgment in 2018 following concerns regarding the risks involved with online eKYC.

Private entities can now use online eKYC provided that they obtain clearance from UIDAI to do so, and after paying an eKYC licence fee of around ₹ 25 lakh. Private entities must also pay a ₹ 20 transaction fee for every eKYC verification performed.

Offline eKYC methods are still available for use by private entities.

Banks, insurers, securities intermediaries, and any other business in the regulated sector can make use of eKYC to quickly and digitally verify customer identity.

How can businesses conduct eKYC?

The mandated regulations for eKYC are laid out by the respective regulatory bodies such as IRDAI, SEBI & RBI.

eKYC has now largely been universally adopted by regulatory entities to perform customer verification due to the ease of the process.

The eKYC process itself is quite simple and expedient to perform. Here’s how online eKYC will go.

- The customer provides 12-digit Aadhaar number

- Customer either generates OTP on their registered mobile number or biometric scanners are used to scan fingerprints or retina

- OTP is verified by UIDAI or scanner readings are verified with original fingerprints & retina scans

- Once verification is complete, UIDAI releases demographic information to the agent or organization performing eKYC. This information can be stored in a remote server for easy access.

In order to further facilitate customer verification, SignDesk offers both online & offline Aadhaar eKYC services, along with Aadhaar-enabled eSign for easy document signing.

eKYC – Pros and Cons

eKYC is extremely easy to perform for businesses, but should eKYC be widely used?

To answer this, we must consider the pros and cons of eKYC.

eKYC affords numerous advantages to both businesses and customers, these include –

1. Instant verification

eKYC allows customers to be verified almost instantly. By digitizing KYC verification, eKYC reduces the time taken to verify a customer from 10-20 days to mere minutes.

This has precipitated an enormous reduction in operating costs for businesses, estimated at 90%, and a stark rise in efficiency and time saved.

2. No verification charges

eKYC verification is completely free. This incentivizes businesses to use digital means of verification rather than the traditional paper-based methods and allows businesses to divert funds normally meant for KYC compliance into other areas that add value for customers.

3. Increased security

The usage of biometric technology for customer verification and the data security measures in place for the Central Identities Data Repository (which houses Aadhaar information), ensure that customer data is safe and frauds are deterred.

4. Zero paper documents

eKYC requires no identifying documents, as all the information required to verify a customer is directly available from the Aadhaar database.

This reduces dependencies on paper-based documentation and has been shown to boost productivity by 20%.

The ease of the eKYC channel also encourages customers to go through with the authentication process and not stop the process mid-way.

5. Market penetration & financial inclusivity

India has over a billion Aadhaar cardholders, and all their information is available in the UIDAI database. With eKYC directly integrated with this database, businesses no longer need to invest large magnitudes of funds to expand their markets.

This is because the initial verification process (eKYC) required to onboard customers is now both free and easy to use. eKYC allows customers with Aadhaar to be verified instantly with minimal machinery to be put in place on the side of the verifier.

Hence, businesses can use eKYC to expand cost-effectively into new markets and bring more customers into the official financial sector by providing them with the opportunity to easily open accounts, obtain insurance, or invest in mutual funds.

While the benefits are substantial, eKYC comes with its own set of cons.

The primary disadvantage of eKYC is that it’s the minimum KYC required in most cases. This means that accounts opened following eKYC will have restrictions, including –

- The maximum balance of an eKYC account cannot exceed ₹ 1 lakh

- In a financial year, funds exceeding ₹ 2 lakh cannot be added to the eKYC account

- A minimum KYC account can only be used for a year, after which full KYC must be completed for continued use

eKYC is a welcome change from the usual paper-based KYC verification methods, but it still has its own drawbacks.

Can eKYC be improved upon?

How Video KYC improves upon eKYC

We’ve seen that eKYC only constitutes the bare minimum of KYC, but the process is also completely digital and hugely beneficial for customers and businesses alike.

Therefore, in order to improve upon eKYC, a digital process to complete full KYC would have to be introduced. This is precisely what RBI accomplished in its recent notification regarding the Video-based Customer Identification Process ( V-CIP).

Video KYC, as this process is popularly known, has also been embraced by SEBI & IRDAI in the form of Video In-Person Verification (VIPV) and Video-based Identification Procedure (VBIP).

Video KYC allows full KYC verification through a completely digital channel. eKYC is also incorporated into Video KYC as one of the initial steps.

Video-based KYC takes the spirit of eKYC even further by incorporating digital ID verification, audio-visual interactions, and facial matching into the digital KYC process.

Although accounts opened via Video KYC are subject to stringent due diligence and audits, they are still full-fledged accounts, providing customers all the facilities available to regular account holders.

Therefore, Video KYC takes the project begun with the introduction of eKYC to completion, and allows for a totally digital verification process.

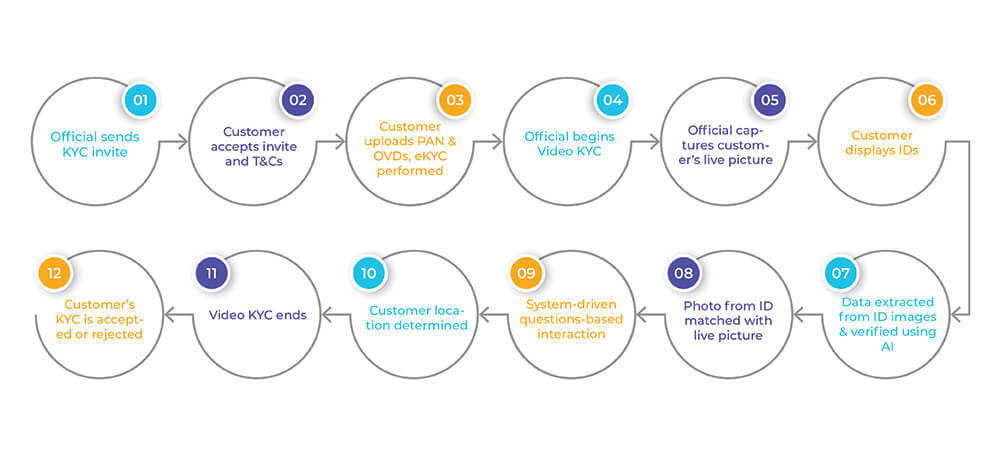

What are the steps involved in Video KYC?

RBI, IRDAI and SEBI have all mandated their own processes to perform Video KYC. These individual processes have some steps in common and are applicable to businesses depending on their sector.

You can read about the steps in RBI’s VCIP here, IRDAI’s VBIP here, and SEBI’s VIPV here.

Verification services providers are now offering comprehensive KYC and onboarding solutions that support all the workflows involved in Video KYC.

SignDesk provides a sector-wide ID verification solution that allows businesses to quickly and easily perform Video KYC using these steps.

Here’s what Video KYC will look like with SignDesk’s AI-powered KYC verification solution.

Video KYC, therefore, takes place on a completely digital channel, and affords all the benefits of eKYC and more.

Video KYC: End-to-end digitized KYC

Similar to eKYC, Video KYC also provides businesses and customers with all the advantages of digital KYC verification, along with some unforeseen benefits.

Here’s why you should be using Video KYC to verify customers.

1. Reduced operating costs

Adoption of Video KYC for KYC verification has been coincident with massive reductions in onboarding and verification expenses.

SignDesk’s clients have seen up to a 90% reduction in operating costs due to the digital nature of Video KYC.

2. Reduced turnaround time on KYC

KYC verification, including customer identification & document verification, takes a combined time that stretches between 10 and 20 days.

Video KYC removes manual and paper-based inefficiencies, and consequently significantly reduces the turnaround time on customer KYC.

SignDesk’s clients have seen a 99% reduction in TAT, from 10 days to 10 minutes.

3. Safe & secure KYC verification

Due to the restrictions imposed by the COVID-19 pandemic, we now need digital verification methods more than ever.

Video KYC allows customers to avail services from the safety of their homes, using nothing except a device with an internet connection. Following the introduction of VCIP from RBI, several millions of people have opened accounts using Video KYC.

The facial matching methods and AI-based document verification methods used in SignDesk’s KYC verification solution additionally provide added security and protect from cyber fraud.

4. No manual or documentation errors

Video KYC ensures minimal verification and documentation errors by automating KYC verification.

Reports indicate that digitizing boosts efficiency by 20% and massively reduces errors. By adopting Video KYC, businesses can improve productivity and seriously reduce the scope for manual errors.

5. Fewer KYC drop-offs

Customers are increasingly demanding for a smooth and digital channel for onboarding.

The KYC process in place for most businesses is fragmented and takes place over several channels. This has led to a 40% KYC drop-off rate across Financial Institutions (FIs). Additionally, Marketforce reports that 55% of customers would prefer digital identity verification.

Video KYC solves these issues by providing a robust workflow for KYC verification that takes place online.

SignDesk’s smart and intuitive solution interface has precipitated a 20% reduction in KYC drop-offs for our clients.

6. Returns on investment

FIs the world over and increasing investments in AI-powered KYC and compliance.

Deloitte estimates that digitizing the KYC workflow can improve productivity and returns on investment by 50%, and several academic studies similarly indicate that returns on investment will only be realized after the complete digitization of KYC.

Video KYC, therefore, is an easy way for stakeholders to improve returns on investment in FIs.

Now that we’ve established the superiority of Video KYC to the other available verification methods, how can your business start implementing Video KYC?

Award-winning customer verification

SignDesk is an award-winning RegTech pioneer providing AI-powered verification and documentation solutions to businesses.

We use real-time document verification techniques, OCR-enabled image data extraction, facial matching & ML-based fraud filters to automate and expedite the KYC verification process.

Our verification solutions have helped our 250+ clients reduce onboarding expenses, cut down on KYC drop-offs, reduce TAT by 99%, and safeguard against fraud using cutting-edge compliance technology.

Our efforts to automate KYC have been recognized in the form of numerous awards, the latest being the Best AI/ML Product at InnTech 2020, and the Global Banking & Finance Review’s Best Digital Onboarding Product of 2020.

Are you ready to join 50+ major banks and start onboarding with Video KYC? Book a demo with us now and let’s get started!